17 January 2025 |

2 minutes

A volatile year for investors, but not for all...

2024 was another year of some unforeseen events in the global market, resulting in another volatile year for investors.

Volatility itself does not necessarily hinder long terms returns for investors, but it can make some investors anxious and cause them to sell investments at the wrong time. Global economic and geopolitical uncertainties, together with domestic policy changes can present both opportunities and challenges for investors.

Closer to home in 2024, we also saw volatility; the UK stock market hit a record high, whilst domestic policy and uncertainty weighed on the market towards the end of the year.

Long-term investing

It is important for those investors with long term goals to remain invested. This is reflected in Wesleyan’s approach, investing to buy and hold assets based on strong fundamentals.

This year saw the 3-year anniversary of Wesleyan’s smoothed With Profits Growth Fund being available to advisers on platforms. The aim of the fund is to provide capital growth over the medium to long term by investing in UK and international equities, bonds, property, cash and other related investments.

Alongside this, the fund helps investors to ‘stay the course’ for their investment goals, by managing volatility through smoothing - on a uniquely daily basis.

2024 fund performance

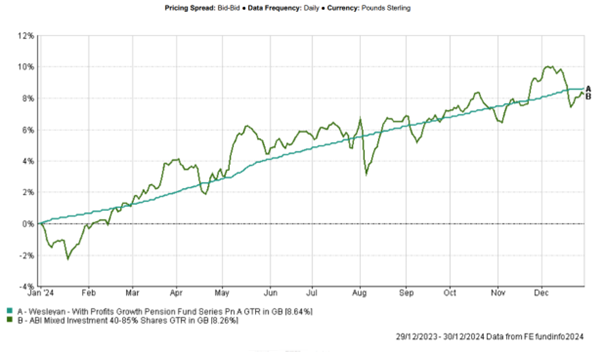

2024 was an excellent case study in how the investment journey and total return for an investor in this smoothed fund performed, comparing favourably at 8.64% net of charges against the ABI Mixed Investment 40-85% at 8.26%.

The blue line in the chart below illustrates how the positive investment returns from investing in a basket of growth assets have been captured, without the volatility of a widely referenced benchmark, the ABI Mixed Investment 40-85%.

If you’d like to understand the fund in more detail, we have a UK-wide team ready to support you.

Please note that past performance is not a reliable guide to future performance and the value of your investment, and any income can go down as well as up, so you could get back less than you invested.

For professional adviser use only.