10 February 2025 |

4 minutes

How much will I get paid as an F1 doctor in 2025?

Being in medicine isn’t all about money, but it’s handy to know what you’ll earn as you enter the world of work in 2025. Not least so you can budget effectively.

There are lots of financial considerations when starting work. How much rent can you afford? Will your cost of living remain the same? Do you need to think about additional expenses?

So, it’s not only good to know what salary you’ll earn, but also how much pay you’ll actually take home after deductions like Income Tax and National Insurance. Learn everything you need to know in this blog.

Salary

Here is a list of starting salaries for each of the UK nations:

- England - £36,616

- Wales - £33,307

- Scotland - £33,724

- Northern Ireland - £29,556

Net (or take-home) pay

As explained, your net or take-home pay is the amount that lands in your bank account after all deductions have been taken from your salary.

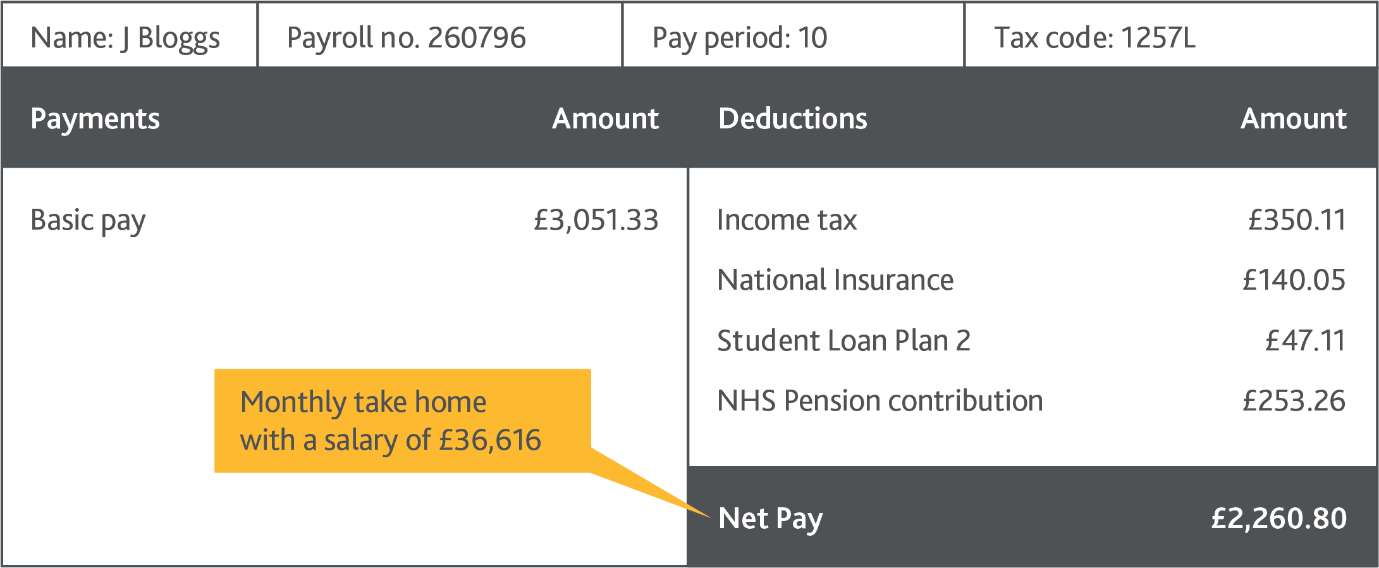

This simplified example of a payslip helps you to visualise the deductions made from your monthly salary. Using FY1 pay in England for 2024/25 as the basis, it explains how you get from your basic pay (your annual salary, simply divided by 12) to your net pay (the final amount paid into your bank account after all the relevant deductions).

For those of you in Scotland and Northern Ireland, your tax, National Insurance and student loan rates can differ from those in England and Wales. With this in mind, be sure to check out the government website for more details.

Also, depending on where you’re working and your shift pattern, you may be entitled to pay uplifts. For more on boosting your basic pay and what you need to know about your finances when starting work, download our Financial Survival guide.

How is my tax, National Insurance and student loan calculated?

All of the above is charged at a certain percentage above a threshold once you earn enough money.

Income Tax in England, Wales and Northern Ireland is calculated at 20% on your salary above £12,570 (the personal tax-free allowance for 2025/26). The higher your earnings, the more your salary will attract increased rates of tax. In Scotland, your tax rates differ slightly. You can learn more about income tax in Scotland on the government website.

National Insurance is calculated at 8% above an earning threshold decided by HM Revenue and Customs each year.

How is the NHS pension calculated?

A pension allows you to build a sum of money so you can retire on your terms and the sooner you begin this the better.

In the example above, an F1 starting work in England in 2025 will contribute 8.3% of their salary and in return, the NHS contributes a whopping 23.7% (rates differ for each country and salary band). This means that, in this example, the employer contribution amounts to £723.17 per month.

Just to note here, if you aren’t part of the NHS Pension Scheme, this sum of money would be liable to Income Tax, National Insurance and student loan deductions. So, while opting out is an option, you’ll be sending more to the taxman along with losing the £723.17 a month given to you by the NHS. Plus, other benefits that can’t be backdated.

It’s always good to have a chat to a specialist adviser if you’re considering opting out. This way you can make an informed decision with all of the pros and cons in mind.