Our approach, at a glance

- We follow a ‘buy and hold’ strategy in favour of long-term value over short-term gains

- We favour equities, which, we believe, over the long term are better able to withstand the ups and downs of the markets

- We diversify portfolios to reduce risk and, wherever possible, protect your funds from market upheaval

- We reinvest dividends to encourage further growth on any initial gains

The strongest of values

Our heritage

As a mutual, we’ve been owned by our members for over 180 years, meaning there’s never been any shareholders pushing for short-term gains.

A focus on the long term

Our financial strength and risk-averse culture underpins a focus on delivering strong investment returns over the longer term.

Contributing to a better world

It’s not just how we invest your money, but also how we serve communities and our impact upon the wider world.

An active approach to investing

Reinvesting dividends

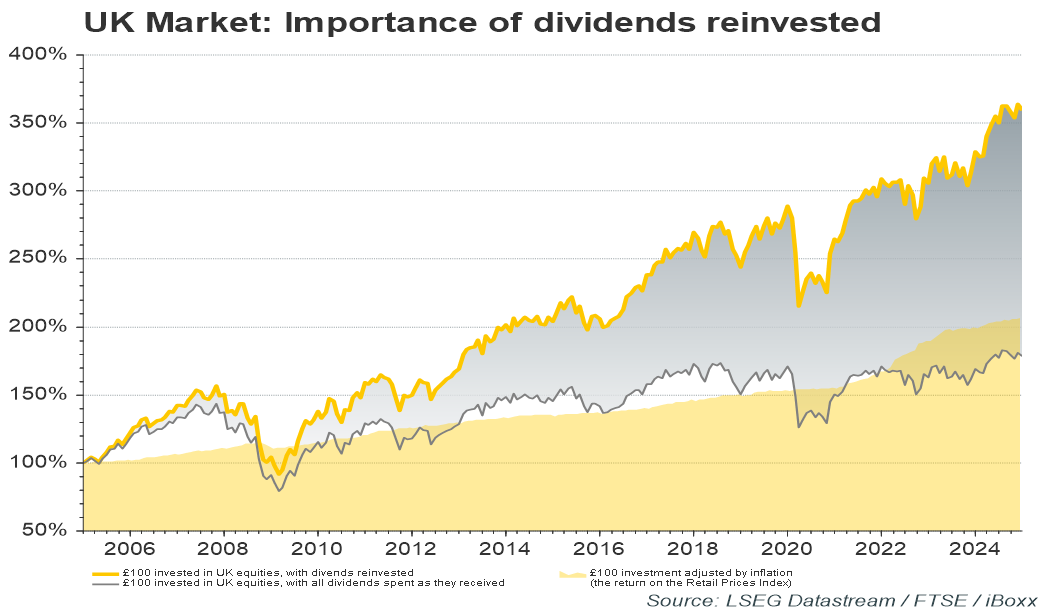

A key part of our approach to investing is to reinvest any dividends paid out on equities.

Dividends are a form of income that a company may pay out to shareholders. Through the reinvestment of dividends, further growth can be gained on any initial growth you may receive.

The graph shows how reinvesting dividends could have an impact on the overall growth of your investment. In this case, the percentage growth of £100 invested in 2005, up to the end of 2024.

How we invest your money

As we have no shareholders, our focus is solely on achieving a better outcome for you and all our members.

Our key strategy of ‘buy and hold’ means investments are intended for the long term (a minimum of five years but typically 10 years or longer). Our Fund Managers look to identify equities that may be out of favour with others but have the potential to grow in value over time. So, when the markets are down, we are more likely to be buying equities than selling them.

Putting you first

The best interest of our members is at the forefront of everything we do, so you can be sure we will always:

- Manage your investments for you - Your investments are actively managed by a team of expert specialist Fund Managers

- Target sectors and shares with long-term value - The Fund Managers look to maximise your growth through smart investments that achieve long-term returns

- Be patient - Our ‘buy and hold’ strategy means we often benefit from lower trading costs, meaning, in turn, you benefit too

Sustainable investing

Wesleyan is committed to investing in companies that adhere to our sustainability principles.

To reinforce this commitment, we have a Sustainable Investment Team working alongside our Fund Managers and Investment Analysts. Their job is to assess our funds, holdings and investment decisions by considering environment, society and governance (ESG) factors under our core principles of reducing harm, having a positive impact and driving change.